Are constant Lender Handbook Part II changes leaving conveyancers vulnerable against PI claims?

An easy to use defence against unpredictable Lender Handbook changes

Lenders change their Part II policies as often as they deem necessary. Staying on top of these changes doesn’t have to present difficulties for solicitors.

The importance of checking Lender Handbook requirements cannot be overstated, as not doing so can result in a failure to pass an externally commissioned lender audit. Such failures leave law firms open to:

- insurance claims

- removal from a panel

- potential action from the SRA

- additional reputational damage that no price can be put on

Having access to essential lender requirement changes before submitting the certificate of title (CoT) is key to protecting your law firm against costly suits, or a heavy blow to your reputation.

The volume and frequency of changes mean it’s easy to miss key updates. Out of 250 lenders:

- 75 lenders updated their requirements in 2020

- 62 lenders have updated in 2021 so far

- There have been 130 updated questions in the last 30 days

Part II Handbook requirements should always be checked for changes before submission of your CoT. You can now do this easily, efficiently and with complete peace of mind with the LC-5 Lender Check.

Safeguard your law firm with an easy to use, accurate report on any UK Finance listed lender

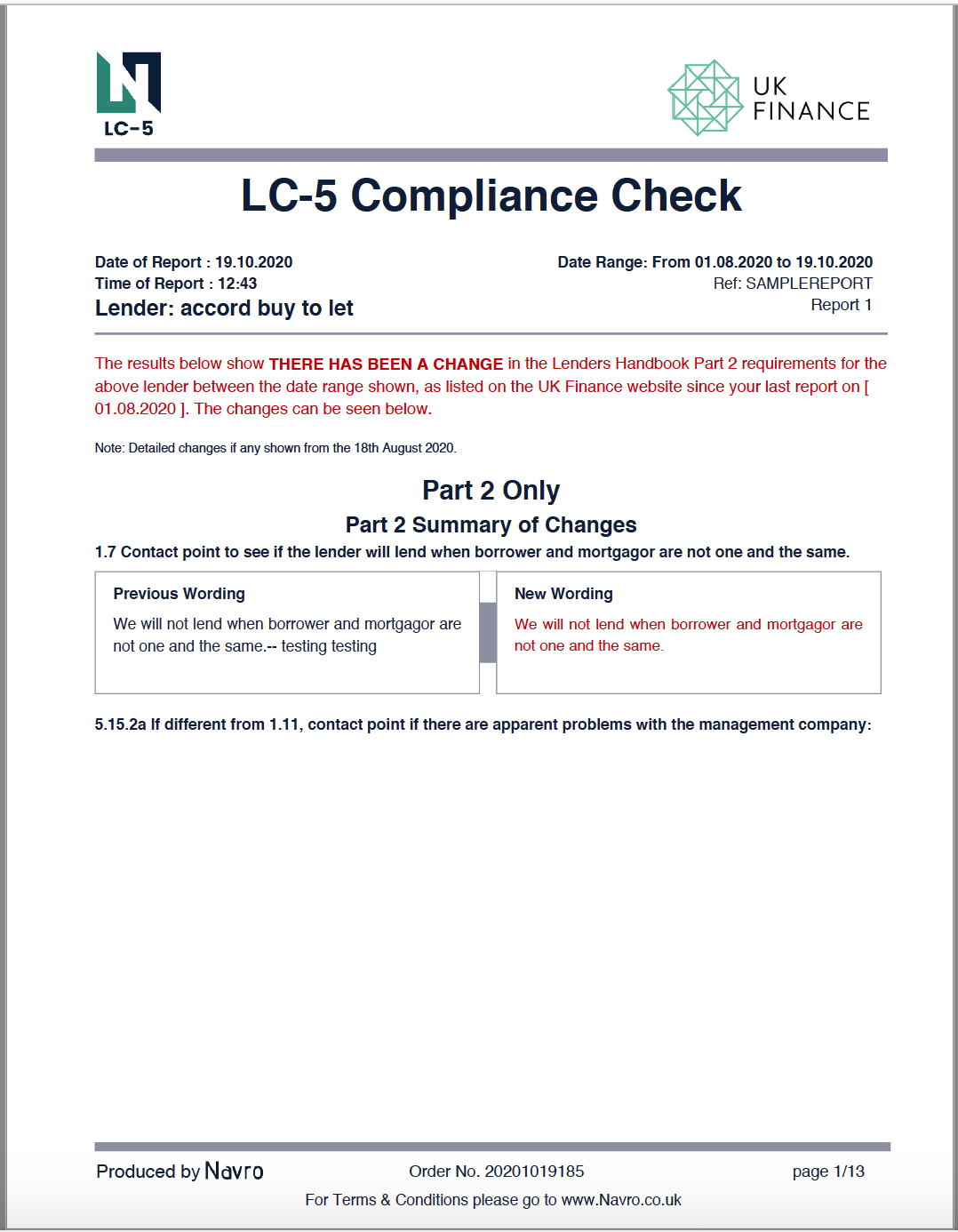

To help mitigate the risks of non-compliance, OneSearch Direct is making the LC-5 Lender Check from Navro available to all customers. This report clearly highlights any changes in the Lender’s Handbook Part II requirements for the relevant lenders within a specified date range.

You are immediately shown a comparison between the previous and new wording in summary and then in detail. Pinpoint the information you require. Double-check as part of your due diligence easily and efficiently.

You will also be advised if there have been no changes. So, should you be audited, you have a simple, visual record of your compliance. With the LC-5 Lender Check, UK Finance Part II requirements are interrogated 4 times a day.

- Old and new answers are shown in summary for instant comparison

- Easy to use – simply complete the relevant details

- Update your report at the click of a button

Not only is it clear to interpret and easy to order, but you can also rely on the accuracy of the results:

- Refresh your LC-5 up to 5 times per case

- 24/7 updates available

- Available for any lender listed by UK Finance

- Keep in case file for auditing purposes

|

|

|

The LC-5 Lender Check means peace of mind, convenience and accuracy. Because it was developed by conveyancers for conveyancers, the LC-5 report ticks all the boxes and gives you the confidence to know you’re adhering to the most up to date changes.

Not only that, but you can standardise best practice procedures for intra and cross-branch compliance.

For a limited time only, we are offering one free LC-5 Lender Check to conveyancers. Simply tell us the name of the lender you would like to check (they must be a UK Finance listed lender), and we will send you a report of any changes within the last 7 days. Click here to claim yours now.

For more information, please email intro@onesearchdirect.co.uk or call 01782 433270.

Related Articles

Anti-Money Laundering Compliance: All You Need to Know for 2024

Happy 30th Birthday Landmark Information!

OneSearch Hospitality Day: Exeter v Bath

![[LATEST REPORT] Residential Property Trends, Q1 2024](https://onesearch.direct/wp-content/uploads/2024/04/LM-RESI-PTR-APR24-Social-1024x536.jpg)

[LATEST REPORT] Residential Property Trends, Q1 2024

Five minutes on… PEPs and Sanctions

Five minutes on… Ongoing Monitoring

Five minutes on… Remote Identity Verification

Let’s Talk About Mental Health and Well-being in Conveyancing

The State of Conveyancing Transaction Times and the Promise of Material and Up-Front Information