We are delighted to welcome Claire Slade to the OneSearch team as Business Development Manager.

Claire brings over 20 years of experience in the business development field, having cultivated strong relationships and driven significant revenue growth throughout her career. For the past three years, Claire served as a Business Development Manager at OnTheMarket. Prior to that, she held positions at Yell, Mercedes Benz Finance, and Pendragon.

In her new role at OneSearch, Claire will be responsible for executing strategic initiatives to ensure conveyancing professionals and property data providers can obtain all the property information they need in one place, as well as providing them with the tools they need to complete transactions faster and with greater ease.

“I am thrilled to be joining OneSearch at such an exciting time for the company,” said Claire. “OneSearch’s reputation is unparalleled in the industry, and I am confident that I can play a key role in helping businesses leverage this data to achieve their goals. I am looking forward to working with the talented team at OneSearch and building strong partnerships with our clients.”

Elizabeth Jarvis, Managing Director at OneSearch, added:

“We are delighted to welcome Claire to the OneSearch team. Her extensive experience and proven success in business development make her a valuable asset. Claire’s expertise will be instrumental in driving our growth strategy and expanding our reach within the search and property data market.”

Tired of spending hours on Anti-Money Laundering checks?

We’ve all been there. But what if you could streamline the process and get it done in minutes?

In the following video, we’re introducing you to OneSearch AML, your one-stop shop for fast and efficient Anti-Money Laundering checks. We’ll take you step-by-step through the process of adding OneSearch AML to your conveyancing order, and show you exactly what your client will experience during verification.

See how it works in the video below:

Get ready to say goodbye to lengthy AML processes and hello to a smoother conveyancing experience!

We are delighted to launch our new innovative AML check designed to enhance the way property professionals manage compliance and transactional due diligence.

OneSearch AML harnesses market-leading technology and offers conveyancers an up to date Know Your Client checker in the fight against fraud in the sector, all whilst ensuring adherence to recently updated industry standards and guidelines.

Ongoing monitoring

New digital advancements have meant that previous methods of identity verification within the legal setting such as manually checking documents, face-to-face meetings, and waiting for postal deliveries for documents have become outdated. Now, with biometric scanning, NFC technology, secure encryption, and cloud-based storage, ID checks are a far more safe, accurate, and effortless part of the conveyancing process.

Furthermore, OneSearch AML offers ongoing monitoring checks, which provides post-sale examinations of any changes, developments, or updates to customers profiles over a 12-month period.

Robin Wells, Head of Sales Operations at OneSearch added:

“The launch of OneSearch AML underlines our ongoing commitment to empowering conveyancers in navigating their day-to-day workflow, and in this case, support for any complexities that run alongside AML due diligence.

“For us, we know and understand the complexities of KYC regulations of our clients – assessing risks, identifying suspicious activities, and especially ongoing monitoring are all imperative to our customers and to the industry as a whole. OneSearch AML solution delivers quick, secure, and accurate cover across all these areas.”

Challenges in Anti-Money Laundering Compliance

The launch aligns with insights from the SRA’s Anti-Money Laundering annual report, revealed in October 2023, which highlighted certain areas needing attention within law firms. Among the observations, it was noted that a portion of reviewed firms, specifically 66 out of 224, require additional support to fully comply with anti-money laundering regulations. Unfortunately, the legal sector often faces challenges regarding money laundering, contributing to a broader concern around the flow of approximately £100 billion in illicit funds through UK businesses and financial institutions each year.

Elizabeth Jarvis, Managing Director at OneSearch said:

“The message from the SRA annual report was clear. All legal firms need to ensure they are committing time and resources to counteract modern money laundering attempts, and we offer our strongest support with OneSearch AML.

“The service has been created to be the single, comprehensive solution for our customers, easing any worry or burden they may have over how best to comply with all relevant standards and guidelines.”

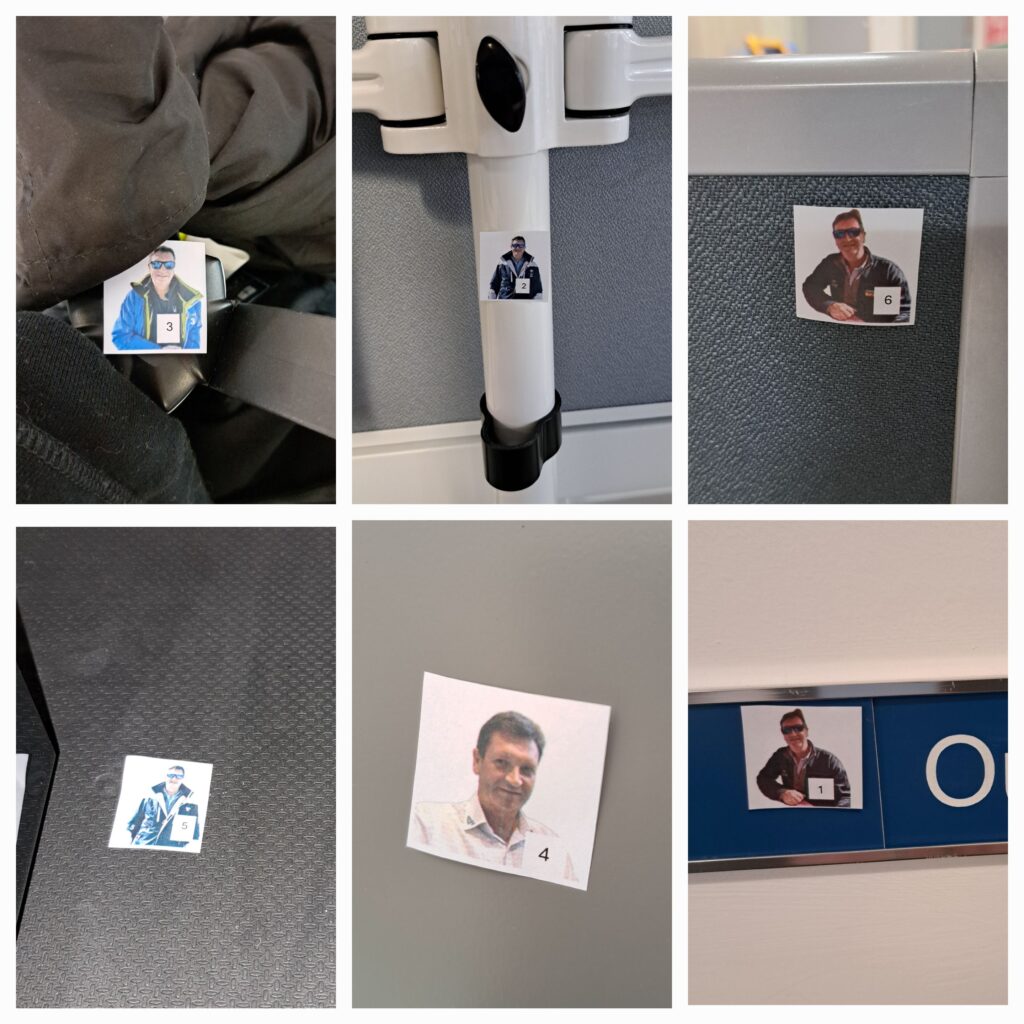

Last week, our parent company Landmark Information Group turned 30! 🎉

To celebrate the big 3-0, staff up and down England and Scotland were in party mode with fun days in each office, which included breakfast, games, and a team walk, and OneSearch were no different!

“Our goal is to make property transactions feel effortless – for everyone. We’re redefining what’s possible and plan to be at the forefront of innovation for many years to come.”

– Landmark Information Group

🏠 Here’s to the next 30 years of streamlining transactions and transforming the property industry!

Read more here

The Q1 2024 release of Landmark’s Residential Property Trends Report is now available. This report contains the most recent data from the residential property transaction pipeline, covering listings, SSTC/SSTM, searches ordered and completions.

Our latest data gives reason for cautious optimism: listing volumes remain strong, building steadily through Q1 ‘24 in England and Wales. Listing numbers in Scotland also began on a positive footing.

Key findings from Q1 ‘24 include:

- In England and Wales, listing volumes in Q1 ‘24 were up 5% vs Q1 ’19. Listings in Scotland were down just 2% in Q1 ‘21 vs Q1 ‘19.

- SSTC volumes in England and Wales for Q1 ’24 tracked 32% below Q1 ‘19, with SSTM levels in Scotland 22% down vs Q1 ‘19.

- Completion volumes in England and Wales for Q1 ‘24 were down 41% compared to Q1 ‘19 levels. In Scotland, completions were down 2% in Q1 ‘24 vs Q1 ‘19.

Download the Cross Market Activity edition covering England, Wales and Scotland, unveiling the latest residential property market data and insight for Q1 ‘24.

We trust you’ll find this report to be a valuable guide as we move into the second quarter of 2024.

It is that time of year again when conveyancers from across the UK come together to discuss important matters within the industry and trends for the future – National Conveyancing Week 2024.

The theme for the second day was mental health and well-being in the property sector, a topic that is often overlooked. In 2024, what are the residual impacts of COVID-19 on our sector’s mental health, what are the pressures faced by conveyancers, and what does working from home mean for our mental well-being?

Four years on from the COVID pandemic

While it may seem a long-distant memory for some, some within the industry believe that conveyancers are still reeling from the impacts of COVID-19 on UK property transactions. Robin Wells, Head of Sales Operations:

“I still firmly believe, as much as people will deny it, we’re still in a post-COVID slump in terms of struggling to cope with what happened and struggling to cope with what is normal.“

The loss of human contact felt during the pandemic and since the shift to working from home has undoubtedly left many feeling isolated and lonely and grappling with the question of what normal now means. Robin goes on to say:

“What is normal now? What’s a normal working environment? What’s work-life balance? What should that be? These are all buzzwords and things that are being said, but actually, what is it? What’s healthy? What’s not healthy? I think people trying to come to terms with that and find out what it is and how they get the best out of themselves and the best quality of life while working in this environment is tough”.

It may be that, in many ways, we are all still somewhat shocked by what happened in 2019 and 2020. Not everyone has had the chance to go back, debrief, and have a collective conversation about what happened, how we felt, how we now feel, and what it now means for our livelihoods. National Conveyancing Week provides an excellent forum for this to happen.

The relentlessness of the industry on mental health and well-being

For conveyancers in the UK, the relentlessness and demands placed on them can have a negative bearing on their mental health and well-being. The seemingly endless cycle of meetings on Teams and Zoom can also make us feel disconnected. This is a sentiment that Robin Wells, Head of Sales Operations at OneSearch, resonates with:

“It is nice to go out with a customer out of the office and just say, how are you? It’s as simple as that. How are you? You’re not selling anything. That comes later. But you’ll just say, how are you? How have you been? How are you feeling? I mean, because of COVID, people don’t talk like that anymore. It’s straight onto teams, straight onto an agenda”.

So what is the solution? For Elizabeth Jarvis, Managing Director, the key is setting boundaries and being present with loved ones:

“It is easier said than done and as somebody who used to be the world’s worst for being on email late at night, it is putting firm boundaries in place for yourself. Not just for you but for being present for your loved ones, for people around you and your family. Because I think we all recognise that when your home life is going well then that has a really good positive impact on your professional and your working life too. So you don’t just owe it to us, we owe it to the people who are closest to us as well”.

Emotional rollercoaster

Conveyancers often find themselves responding to the demands of a market that is either overheated or in a lull. The impact of this on mental health is overlooked, but the reality is we are sometimes swinging from too busy to not busy enough, resulting in concerns over job security, a genuine ‘emotional rollercoaster’. As Elizabeth Jarvis explains:

“You see, when you look at it, you think when it’s boom, it’s stressful because we’re running about like mad trying to get all these transactions through when we think about 2022, everybody was just running to stand still. People were working huge hours, you know, just trying to get all these transactions through and make the most of a really buoyant market…And then the market flattens and goes towards a natural connection again and it takes time for it to come back. And then that’s when everybody realises that they need to be really competitive. And how do they do that? And, you know, how do they retain the talent through the difficult periods?”.

Final words

We should make the most of any opportunity to discuss the mental health of conveyancers. We have all been through such an immense period of turmoil in the form of COVID-19, and market conditions remain uncertain with the background of war in Ukraine and stubbornly high mortgage interest rates. The more that we can all get together, laugh, reflect, and be optimistic about the future, the better for our collective mental health. For Elizabeth Jarvis, “It is about getting in to see a customer, getting to see your colleagues again, having that laughter brought back in again into daily life”. After all, the British are experts at this; a packet of your favourite biscuits, a cup of tea, and a chat, is sometimes all it takes to feel ‘normal’ again.