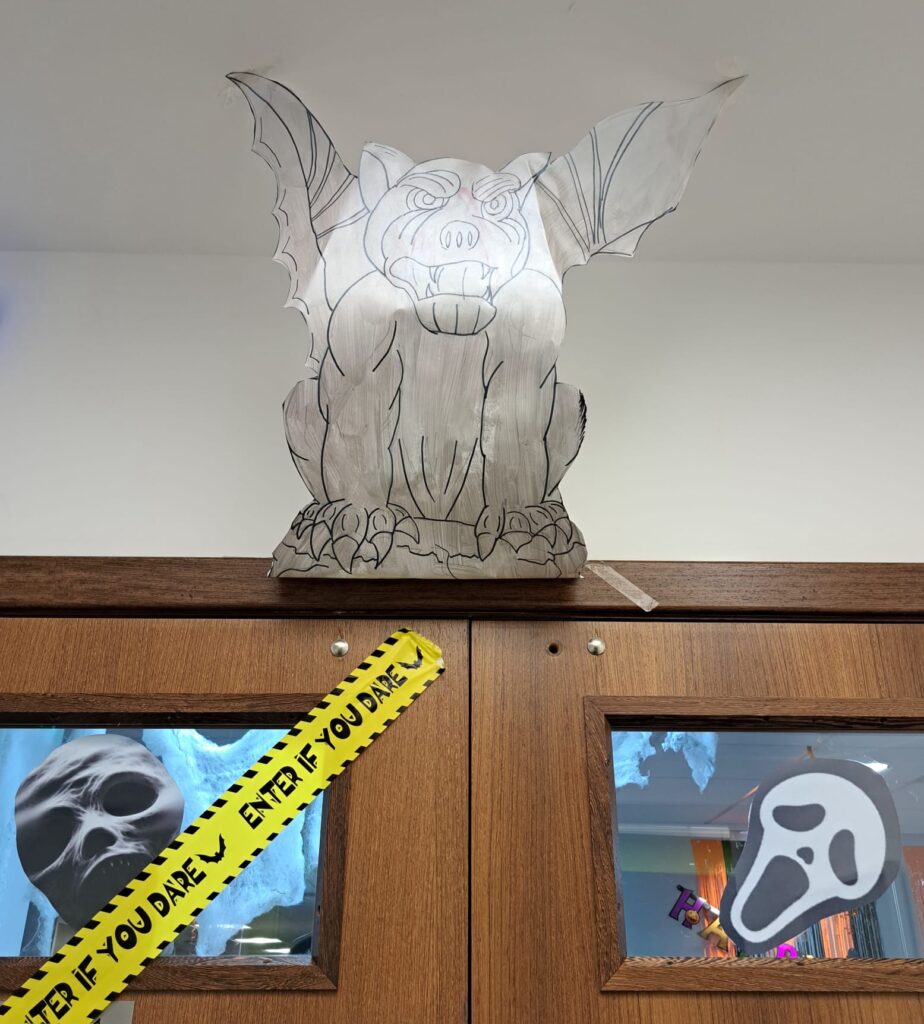

At OneSearch, Halloween isn’t just about tricks and treats – it’s also a time for our team to come together and have a blast whilst making a positive impact. This year, our office was filled with laughter, creativity, and spooky fun!

A time of year known for its sweet treats, the day was also a chance for our staff to showcase their baking skills, as many brought in a fantastic array of mouth-watering cakes and spooky snacks.

The best part? Our bake sale raised a fantastic £500 for MacMillan Cancer Support, a charity close to our hearts. It was a sweet surprise that showed that our Halloween celebration was not only about having fun but also about spreading joy and making a difference – we believe in the power of giving back, and this event was a perfect opportunity to do so.

In addition to the fantastic baking, our staff transformed themselves into all manner of ghouls, zombies, witches and wizards for Halloween, and we even found time for a few Halloween-themed games! Our office was adorned with skeletons, cobwebs, and eerie decorations, setting the perfect Halloween mood. Our team truly went all out to make the office feel spooktacular!

Special spooky congratulations to Vicki Hendry in our Ancillary team for winning best costume! Check out the best photos from our team from our awesome Halloween staff fun day.

The residential property market has experienced a number of extreme stressors over the past 18 months: the cost-of-living crisis, rising inflation, rising interest rates, and the fall-out from last September’s mini-budget … not to mention the economic effects of the war in Ukraine.

No wonder overall market activity is down and transactions in 2023 are running at around 85% of the pre-Covid average (2015–2019). All this considered, you might think that every area of the market would be suffering. But there’s one market segment that’s showing remarkable resilience:

The non-lender buying sector, aka cash buyers.

In this blog post, we’ll look at the reasons behind that market resilience. But also, what are the potential risks for non-mortgage purchasers? And how can you help your cash-buyer clients make more confident investments, without sacrificing the strength of their negotiating position?

Cash purchases on the rise

According to statistics recorded by Savills, cash buyers accounted for nearly 8 out of 20 transactions (38.5%) in January 2023. By contrast, mortgaged home movers accounted for just over 5 out of 20 transactions (25.3%).

Since then, cash buyers’ share of the market has continued to grow. In an upcoming OneSearch webinar featuring Savills Director of Residential Research, Emily Williams, it points to data showing cash buyers comprised about 46% of all transactions in April 2023 – up from around 34% in late 2022.

The proportion of cash buyers is even higher in prime markets. In those areas, buyers tend to be less dependent on mortgage finance. For instance, this year in prime central London as many as 14 out of 20 buyers (71%) have purchased using cash only. That’s up from around 12 out of 20 buyers (60%) in 2022.

What factors are contributing to this resilience?

Cash buyers have, in fact, represented the largest market segment since 2011.

One reason for their apparent recent growth is down to the surge in lender-backed purchases post lockdown. Increased activity from mortgaged home movers saw cash buyers’ market share squeezed between 2020 and 2022.

Since March 2021, we’ve seen the proportion of mortgaged-backed purchases drop from 1 in 3 transactions to around 1 in 4. And while the market turmoil in the wake of the mini-budget made the headlines in October 2022, a noticeable falling-off in transactions has been evident since the stamp duty holiday came to an end in September 2021.

In large part, the dampening effect in the market stems from the cost of borrowing going up. That continues to be the major constraint on first-time buyers and mortgage-backed home movers.

But part of cash buyers’ market strength is also down to their comparative ability to move fast to completion. This can make them an attractive proposition to many sellers. Indeed, those with access to readily available funds can often negotiate a reduced sale price on the basis of a time-limited offer.

Yet a determination to move fast can see cash buyers take on risks that mortgage lenders would not.

To search or not to search?

It’s imperative to understand that searches play a vital role in a property transaction and whatever the circumstances a full range of searches as advised by a conveyancer is always the best way to get all the property information required to make an informed decision. However, some cash purchases are negotiated by buyer and seller and the timescales of search delivery can fall out of these agreed parameters, so some form alternative safeguard maybe required to enable the purchase to proceed.

Bypassing the searches altogether however, is ill-advised. Property searches typically only cost a little extra; the possibility of local authority delays mean that delays could push completion, back several weeks, which is why your cash buyer clients may want to skip this part of the conveyancing process – particularly if they have negotiated a sale using a timescale caveat (e.g., exchange in 31 days).

Fast forward a couple of years, however, to when your client is looking to sell: a more prudent buyer’s searches could uncover defects that were there to be discovered. Defects such as:

- Unauthorised building works

- The property’s location on a floodplain

- The lack of connection to a sewerage network

- Planned changes to traffic schemes

- Proposals for a nearby railway

- Previously rejected planning permission applications

- And many more.

These types of defects can significantly affect the resale value of a property. Not only might your client be unable to achieve the profit they had expected to make, but they might struggle to persuade other buyers and their lenders that their property is worth anywhere near what they paid for it.

Buyer beware

Why might a vendor be keen on a quick sale? Why might they be happy to accept a low offer? And why might they be marketing their property as for ‘cash buyers only’?

These are questions your cash buyer clients should be asking themselves.

It may be that the seller simply wants a fast and uncomplicated sale. Perhaps they need the proceeds quickly and don’t want to risk a sale falling through. So they’re prepared to accept a lower price to guarantee a speedy transaction.

Those are the good scenarios. But it could be they’re trying to rush through a sale so that known defects aren’t looked at properly. And because of the rundown condition of the property, perhaps they suspect that a mortgage provider won’t lend funds to a would-be buyer.

As corner-cutting goes, not undertaking searches can be particularly dangerous. Which is why mortgage lenders would never take the same risk. And why, at OneSearch, we believe a full suite of conveyancing searches remains the best way to gain a true picture of a property and its history.

But now there’s a new way for your clients to secure a level of protection, without jeopardising a speedy transaction or risking a drop in the property’s onward sale value.

Introducing Cash Buyer Express

Created for an area of the residential property market where speed is paramount, Cash Buyer Express from OneSearch has been designed with time-sensitive purchases in mind.

It’s the perfect solution for those cash buyers who don’t want to put transactions at risk but who want to be better informed and suitably protected. The ideal tool for those who don’t want to risk waiting 6–7 weeks for searches to come back, but who want to feel more confident in making what is, after all, a significant financial investment.

How does it work?

Peace of mind… at pace

OneSearch is the only company to hold a national database of most of the available local authority data on every property in England and Wales.

Cash Buyer Express provides up to 70% of the information you would normally get from local authorities. But your clients can expect results in as little as 24 hours, so there’s no hanging around.

In practical terms, a sale will go through just as fast with or without Cash Buyer Express. The difference is your clients will be better informed. More importantly, they will have the security of an insurance policy covering a reduction in the property’s resale value from unidentified defects.

Protection… on purchase

Your clients are protected by a £1 million No-Search Insurance policy with Aviva. This is tailor-made for non-mortgage transactions and provides cover for:

- A search of the local land charges register on form LLC1

- A search of CON29R and/or CON290 records

- A search of water and drainage records on CON29DW

- A search of the coal authority’s records on form CON29M

- An environmental risk assessment

- A full chancel repair liability search

The policy will compensate your clients for the difference between the price they pay for a property and any subsequent reduction in value caused by unidentified issues – for example, the existence of a public right of way – that a full local authority search would have revealed.

In a nutshell, Cash Buyer Express gives cash buyers clarity, confidence, and complete peace of mind – without delay.

This past Sunday saw OneSearch host a corporate hospitality day at St James Street in Taunton, to witness the Metro Bank One-Day Cup cricket game between Somerset and Glamorgan.

James Shepherd, Regional Sales Manager for OneSearch, posted after the event: “Nearly 600 runs scored, great discussions had with fantastic local law firms, 18 wickets fallen, happy clients aplenty and 100 overs of play at Somerset County Cricket Club. Needless to say our OneSearch corporate cricket day was a qualified success! Thanks to everyone that attended and look forward to seeing you all again soon.”

The Q1 2023 edition of Landmark’s Residential Property Trends Report is now live. In it, you’ll find summaries of the last quarter’s residential property transaction pipeline from listings to SSTC/SSTM, and from searches to completions.

The report shows partial signs of market recovery, with supply strengthening throughout the quarter, following the uncertainty of Q4 2022 – but overall volumes remain subdued.

Headlines from Q1 include:

- Supply is up in England and Wales – from 10% lower in January ’23 vs ’19 to 6% higher in March ’23 vs ’19.

- Completions slowed in England and Wales in Q1 ‘23 – down 10% on Q4 ’22 volumes, likely due to the low SSTC figures at the end of Q4 ‘22.

- A slight uplift in volumes across all stages of the pipeline was seen in Scotland

- Consumers’ ability to buy remains a crucial factor in influencing market trajectory after Q4 uncertainty

Download the Cross Market Activity edition for both England, Wales and Scotland, and review the latest data from the UK property market during the first quarter of 2023.

We hope you find it useful.

The latest report from our parent company Landmark’s Market Research analysis focuses on how the residential property sector is embracing automation and deriving benefits from digital transformation.

It’s clear, being able to surface more insights earlier can speed up transactions and deliver more buyer certainty. Landmark asked over 100 residential conveyancers to share their experiences of going digital and moving to a business model that automates more key systems.

Discover:

- The percentage of firms committed to automation and increasing their IT budgets

- The biggest challenges to digital transformation – what’s holding business back

- Which aspects of the sales process might benefit most from more automation

- The percentage of businesses that say automation makes them more profitable

Landmark Information Group collects, manages and delivers data across every part of the property industry’s value chain. The breadth of our work means we can undertake a wide range of surveys just like this one, surfacing key insights on subjects such as automation, Home Movers’ Experiences, and Climate Change.

The guide is available for download now.

We have been made aware that the estimated turnaround time for regulated Local Searches in the Bolton Metropolitan Borough Council area is currently 40 working days.

This is due to a technical problem the council have with an internal system, which is causing significant delays. The estimated turnaround time for official Local Searches in this area is currently 85 working days.

If you do have an urgency with any particular case, or if unexpected delays have put the transaction at risk of collapse, we can support you with OneSearch Express, our indemnity policy which provides a data-rich alternative to standard No-Search Insurance, as it also includes a comprehensive report pertinent to a client’s property. Typically returned in just 24-48 hours, Express provides the majority of data (over 70%) that you would typically obtain from Local Authorities, meaning you and your client can complete quickly, and with more confidence.

Our clients have been using Express since 2015 for instances where search delays have put transactions at risk of collapse, and our claims record is exemplary: there are no claims resulting from our Express searches. This is due to the accuracy of our data, and triple quality check methodology. No other company exists with our dataset, comprised of real-time and historical CON29 data.

If you would like more information about OneSearch Express, please email intro@onesearchdirect.co.ukor call 01782 433270.