As the risk surrounding identity fraud and money laundering evolves, so too does the technology used to fight it. The introduction of a new industry benchmark from HM Land Registry has pulled ID verification into the 21st century.

This quick five-minute read will get you up to speed with this new Anti-Money Laundering touchstone, and the technology which has made it possible, detailing why its adoption can be of huge benefit for law firms and conveyancers dealing with AML.

What is the HM Land Registry Digital ID Standard?

In March 2021, HM Land Registry presented new guidance for a higher standard of identity verification within the industry.

This new benchmark encouraged the use of both biometric and cryptographic technology checks, which would offer a greater level of fraud prevention, as well as enhancing efficiency and convenience during client onboarding.

Upon conducting these checks, the conveyancer would have reached ‘Safe Harbour’ status for that case.

Why was it brought in?

“The current processes in conveyancing do not feel very 21st century and they have proved difficult to maintain in the current crisis. What can we do about it?”

Mike Harlow, Deputy Chief Executive and Director of Customer and Strategy

A Land Registry blog post from May 2020 raised concerns around fraud prevention and identity checking practices within the industry.

The article spoke of the “inconvenience and inconsistency” of outdated, manual verification methods which relied on the variable factor of human ability, compared to the more modern electronic passport checking methods.

Fuelled in part by the COVID pandemic, embracing these modern methods would not only greatly reduce the need for face-to-face meetings, but allow the conveyancer to complete checks in a more efficient, convenient way.

What is Safe Harbour?

If solicitors and conveyancers adopt and adhere to these new guidelines, either for residential or commercial transactions, HMLR will consider them to have “taken reasonable steps” to verify customer identities, and they would have reached Safe Harbour.

This means that HMLR would not seek recourse against the conveyancer should the identity of their client confirmed later in the process to be inaccurate.

How do you reach Safe Harbour status?

The three stages are:

- Obtaining evidence from the client

- Checking the validity of the evidence

- Matching the identity to the evidence

A fourth requirement is an additional check to be carried out by the conveyancer who represents a transferor, borrower, or lessor in the transaction.

What are the benefits to law firms?

Embracing this new yardstick of verification can provide an efficient, cost effective, and reliable approach to legally verifying if a person is genuine when buying or selling properties. Advances in technology such as NFC in smartphones speed up the process, whilst AI authenticity checks can spot fake documents with fast and reliable ease. With these advances bringing peace of mind to a once problematic area of conveyancing, it’s understandable why these guidelines are being adopted in many law practices.

OneSearch and Armalytix are delighted to invite you to an upcoming webinar, detailing the importance of Source of Funds checks in an ever-changing, ever-demanding industry.

The webinar, hosted by Robin Wells and Sheryl Hodgson, will cover an introduction to Armalytix and their history, as well as including:

- What are the regulators saying?

- Why is Source of Funds challenging?

- How is Armalytix changing the Source of Funds landscape?

- What is Open banking?

The webinar will take place on the 27th July, at 11AM. You can sign up for this webinar here.

If you can’t make this date, but would like a recording afterwards, email us here.

We would like to share the Q4 2021 edition of Landmark’s Property Trends Report, which provides a complete summary of the 2021 residential property transaction pipeline from listings through SSTC, search and finally completion milestones in England and Wales, compared to 2019.

Key highlights include:

- The sustained imbalance of ‘supply versus demand’ continues to be the dominant pressure on activity levels in the England and Wales’ residential property industry

- Completions were 30% lower in October compared to 2019, following September’s significant rush to complete ahead of the end of the SDLT incentive

We hope you find our trend reports useful. Please CLICK HERE to access a copy of the Property Trends report.

To take a deeper look into the most frequent conveyancing risks, we produced several articles throughout 2021:

- Ground Stability

- Flood

- Planning

- Coal

- Energy & Infrastructure

Here is a quick run-through of the points of each article and some quick links to their accompanying resources.

Subsidence is thought to affect up to 20% of residential properties in England and Wales. This is costly to the insurance industry with over 10,000 homeowners making claims worth £64 million.

It can be a fundamental problem, caused by:

- the addition or removal of vegetation

- changes in the water table

- mining activity

To find out if there is a risk of subsidence on a property, it is best to order an environmental report which specifically addresses subsidence issues.

This report should provide information on the risk of all forms of subsidence, infilled land, mining and subsidence claim data. RiskView Residential is one such report and can be ordered easily as part of a standard pack.

If subsidence is identified, it is then best to seek advice from a RICS Charter Surveyor to conduct a building survey.

This article was written by Mark Taylor, Channel Manager at Landmark Information and environmental auditor with the Institute of Environmental Management and Assessment. He advises that “over 5 million properties are at risk” from flooding and considers whether this is an issue taken seriously by the conveyancing industry, the government and the homebuyer.

He asks:

- Are we doing enough to protect ourselves and our assets?

- Are we taking risk seriously enough?

- Are we doing enough to protect ourselves from risk where it exists?

- What is within the conveyancer’s control?

As we move forward, should the conveyancer be exploring flood risk as standard? The Landmark flood reports offer a manual review of data by a consultant where an elevated risk may exist, at no extra cost. This is within both the Landmark Flood report and the market-leading All-in-One environmental report, RiskView Residential.

As this article says, change is inevitable. The housing market is going through a period of major change. The government is making headway with updates into what it sees as out of date and complex planning laws. In addition, the government has set itself ambitious targets for building new houses.

This push for urbanisation will affect existing properties in currently rural areas. New towns and some of the larger estates planned will also require additional amenities. All these factors will need to be considered by a potential buyer.

The Landmark Planning report, as well as Landmark’s all-in-one environmental due-diligence report, RiskView Residential uses a unique dataset based on polygons as well as point data to provide the most comprehensive insights into planning data and provides the fullest picture of a property to clients.

Although economic and political influences mean coal mining has now virtually ceased in the UK, old and disused mines and their legacies can still affect a property:

- Subsidence

- Sinkholes

- Opencast mining

- Mine entries (shafts and adits)

This article gives a clear overview of the types of risk that come from coal mining, and looks at several reports that you can obtain through Landmark that all include:

- Easy to digest information on the nature of any risk

- Accurate reporting of risks, even in areas known by The Coal Authority to be problematic

- Technical queries handled by industry professionals and experts

- Thorough industry knowledge of mining information, its complexities and limitations

- Includes a Professional Opinion on the next steps on identified issues

The final article in the risk series focuses on large scale infrastructure projects. The UK Government is planning significant expenditure into infrastructure and the creation of a new National Infrastructure Bank.

This article looks at:

- The rebirth of infrastructure

- Infrastructure and Property

- Green Investment

- Our value of space

- What is being reported and is it reasonable?

Both Landmark’s Energy and Infrastructure report and their market-leading All-in-One environmental report, RiskView Residential provide the information to this, searching to a shorter radius in urban centres so as not to identify an unlikely issue.

We hope you have found this series informative. To find out how to include Risk products in your bundle, please call our Service Introduction Team on 01782 433 270 or email intro@onesearchdirect.co.uk.

AML risks a top priority for the SRA into 2022 and conveyancers need to remain vigilant

We’ve seen caseload volumes return to more normal levels since the SDLT holiday ended. In a way, the industry is returning to some kind of normalcy. So, it’s a good time to ask:

Are AML criminals returning to “normal” as well?

The Financial Conduct Authority (FCA) highlighted in its 2020/21 report published in September:

“For some, the pandemic meant diverting resources away from AML supervisory activity, which inevitably affected the number of assessments they conducted.”

Now is a good time to refocus on AML and check your policies, procedures and training schedule is in order.

Conveyancers need to stay one step ahead of AML criminals

The UK is seen as a high-risk jurisdiction for money laundering. Conveyancing has been designated high risk because of the amounts of money that are moved.

To help tackle complacency, HMRC published a name-and-shame list of businesses that have not complied with the regulations, which includes a number of law firms and estate agencies.

The SRA is also adopting a tough stance with individuals banned from holding compliance roles, and firms issued with heavy fines.

In the 2020/21 AML Annual Report, the SRA stated the main cause of breaches were:

- Inadequate policies, controls and procedures

- Lack of supervision or training

- Staff not following set procedures

In addition, 273 reports of potential AML breaches were made, which most commonly involved no AML risk assessment.

Or failure to carry out:

- Source of funds check

- Customer due diligence

- Identity checks

Although complying with AML regulations can appear daunting, there are solutions available to help conveyancers of every size and budget.

The SRA highlighted major red flags all conveyancers should be monitoring

The SRA’s report states:

“The two areas where we continue to see the most risks relating to money laundering are conveyancing, including vendor fraud (where fraudsters try and sell a property without the consent or knowledge of the owner) and dubious investment schemes.”

The subsequent press release highlighted house sale fraud as one avenue criminals continue to pursue.

The SRA stresses the importance of conveyancer vigilance and lists the following red flags:

- the property price is significantly over or under the market value

- the seller or buyer is reluctant or unable to provide documents

- ID documents do not look genuine

- there is pressure to complete the transaction very quickly

- minimal work is instructed, for example, no searches are requested

- there are complex or unusual circumstances around the transaction

- it is a cash purchase of a property

- funds are coming from or going to unconnected third parties

Conducting these checks manually is time-consuming and prone to error. Ensuring the data you work from are up to date is a huge challenge for a busy conveyancer.

Electronic verification is helping conveyancers to stay compliant – efficiently

The SRA says, “electronic verification tools can help firms carry out these tasks, but it is important that firms use them appropriately.”

The Legal Sector Affinity Group (LSAG) agrees, acknowledging “In an increasingly digital age, it is clear that non-face-to-face customer onboarding can no longer be viewed as always high risk (although it remains a key risk factor to be assessed in the context of the wider relationship) – a more nuanced approach should therefore be adopted to these types of relationships.”

The LSAG goes on to say the use of electronic identification and verification (EID&V) tools may be helpful in that they:

- can improve efficiency in customer identification and verification at on-boarding

- allow the undertaking of checks that may be resource-intensive to be done more efficiently

- can be applied consistently from client to client

- can support ongoing due diligence and scrutiny of transactions

OneSearch’s AML offerings can help keep you compliant

We offer a number of Customer Due Diligence (CDD) checks to support your Know Your Customer (KYC) procedures.

GBG AML (Anti-Money Laundering) Check

This comprehensive report includes:

- UK Deceased Persons Database

- UK NCOA (Alert Flag) Database check

- International Sanctions (Enhanced) check

- International PEP (Enhanced)

This is a powerful combination of the GBG AML Check with a document check to ensure all your bases are covered when verifying the identity of your clients.

- This report on individuals returns seven proofs of identity from six independent sources, including Experian

- Equifax

- Dow Jones

- Companies House

In addition, the Dual CRA Bureau connectivity enables the highest ‘match & pass’ rate in the market.

You can simply add what you need to your order on a case-by-case basis.

Or, to ensure consistency across all cases and branches, set up your existing search bundles with the addition of an AML check.

1 in 4 of the top 500 law firms use the service we recommend and have made available on our ordering platform. To find out more about adding Anti-Money Laundering products to your bundles, call our Service Introduction Team on 01782 433 270 or email intro@onesearchdirect.co.uk.

Are constant Lender Handbook Part II changes leaving conveyancers vulnerable against PI claims?

An easy to use defence against unpredictable Lender Handbook changes

Lenders change their Part II policies as often as they deem necessary. Staying on top of these changes doesn’t have to present difficulties for solicitors.

The importance of checking Lender Handbook requirements cannot be overstated, as not doing so can result in a failure to pass an externally commissioned lender audit. Such failures leave law firms open to:

- insurance claims

- removal from a panel

- potential action from the SRA

- additional reputational damage that no price can be put on

Having access to essential lender requirement changes before submitting the certificate of title (CoT) is key to protecting your law firm against costly suits, or a heavy blow to your reputation.

The volume and frequency of changes mean it’s easy to miss key updates. Out of 250 lenders:

- 75 lenders updated their requirements in 2020

- 62 lenders have updated in 2021 so far

- There have been 130 updated questions in the last 30 days

Part II Handbook requirements should always be checked for changes before submission of your CoT. You can now do this easily, efficiently and with complete peace of mind with the LC-5 Lender Check.

Safeguard your law firm with an easy to use, accurate report on any UK Finance listed lender

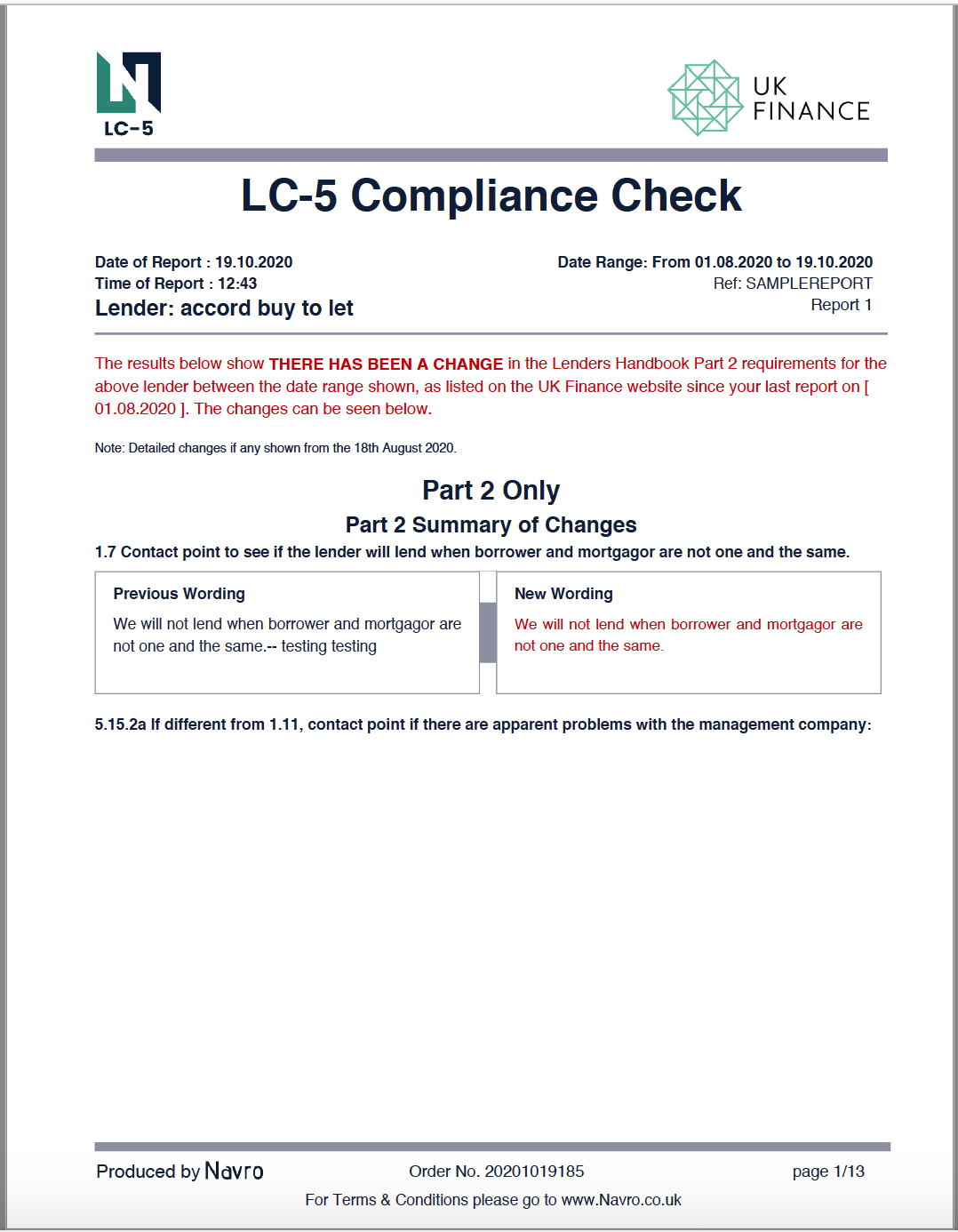

To help mitigate the risks of non-compliance, OneSearch Direct is making the LC-5 Lender Check from Navro available to all customers. This report clearly highlights any changes in the Lender’s Handbook Part II requirements for the relevant lenders within a specified date range.

You are immediately shown a comparison between the previous and new wording in summary and then in detail. Pinpoint the information you require. Double-check as part of your due diligence easily and efficiently.

You will also be advised if there have been no changes. So, should you be audited, you have a simple, visual record of your compliance. With the LC-5 Lender Check, UK Finance Part II requirements are interrogated 4 times a day.

- Old and new answers are shown in summary for instant comparison

- Easy to use – simply complete the relevant details

- Update your report at the click of a button

Not only is it clear to interpret and easy to order, but you can also rely on the accuracy of the results:

- Refresh your LC-5 up to 5 times per case

- 24/7 updates available

- Available for any lender listed by UK Finance

- Keep in case file for auditing purposes

|

|

|

The LC-5 Lender Check means peace of mind, convenience and accuracy. Because it was developed by conveyancers for conveyancers, the LC-5 report ticks all the boxes and gives you the confidence to know you’re adhering to the most up to date changes.

Not only that, but you can standardise best practice procedures for intra and cross-branch compliance.

For a limited time only, we are offering one free LC-5 Lender Check to conveyancers. Simply tell us the name of the lender you would like to check (they must be a UK Finance listed lender), and we will send you a report of any changes within the last 7 days. Click here to claim yours now.

For more information, please email intro@onesearchdirect.co.uk or call 01782 433270.