In collaboration with the UK’s leading law firms, three of Argyll’s environmental SiteSolutions and FloodSolutions reports have been redesigned to improve usability and provide clearer guidance.

These renowned and trusted reports go beyond mere data, offering expert analysis and advice to help real estate lawyers, and their clients proceed with confidence and certainty.

Flexible product portfolio

Our range of remastered reports is designed to meet the diverse needs of property lawyers, offering expert recommendations and bespoke risk assessment across a wide selection of reports. This flexibility ensures that the right solution is available for every transaction, every time.

With this in mind, we are launching our SiteSolutions Combined + Climate Change report which includes Landmark’s market leading climate change module. This element provides a forward-looking analysis of how climate change may impact a property over time, helping clients understand potential long-term physical risks such as increased flooding, heat stress, as well as transitional risks such as energy efficiency of buildings.

Providing SiteSolutions Combined reports both with and without a climate change assessment allows lawyers and their clients a choice to decide whether, or when, this information should be part of the due diligence process and / or satisfy client tolerances. This approach aligns with the updated guidance recently published Law Society’s Property Specific Climate Practice Note.

Tailored reports, trusted outcomes

Argyll Environmental is the leading provider of expert environmental risk assessment and consultancy services for the UK property and legal sectors.

Each SiteSolutions and FloodSolutions report is written and assessed by an experienced in-house Environmental Consultant, transforming complex data into clear, visual insights and plain-language commentary. With meticulous attention to detail, our reports offer bespoke recommendations and overall risk assessments tailored to the context of your transaction. The remastered SiteSolutions range of reports sets the highest standard for commercial environmental searches. With an intuitive design, industry-leading data interpretation, and actionable insight, these reports empower you to deliver exceptional service to your clients.

Introducing the first of our enhanced SiteSolutions range:

- SiteSolutions Commercial

- SiteSolutions Combined

- SiteSolutions Combined + Climate Change

- FloodSolutions Commercial

Your risk report, now smarter and simpler

Our remastered SiteSolutions reports set a new standard for environmental searches. With an intuitive design, industry-leading data interpretation, and upgrades that address today’s most pressing risks, these reports empower you to deliver exceptional service to your clients.

- New landscape layout for easier on-screen reading.

- Side-by-side summary pages for Contaminated Land and Flood, enabling quicker comparison.

- Data summary maps now appear alongside consultant commentary, helping you interpret risks in context.

- Plain English commentary – no acronyms, just clear, relevant insights that enhance the risk assessment.

- Hyperlinks throughout to take you directly to the data you need.

- Improved flood data summary maps for better visual clarity.

- OS MasterMap integration to quickly verify property boundaries and locations.

- At-a-glance risk overview so you can immediately see what needs your attention.

- Clear author contact details for quick access to expert support when needed.

Explore the future of environmental due diligence. To find our more, click here.

On the latest episode of Landmark Talks Property, we were joined by OneSearch Client Relationship Manager John Margett and Tom Lyes, Head of Legal at Armalytix, to take a deep dive into the complexities surrounding Source of Funds (SoF) and Anti-Money Laundering (AML) guidance within the legal sector, particularly for conveyancing.

The conversation unpacks the crucial ‘golden triangle’ of technology, people, and processes, emphasising that all three must be harmoniously integrated and invested in for effective AML. Tom shares his perspective on how the residential property sector has notably adapted to tightening AML pressures, even setting a precedent for other industries. Looking ahead, the discussion touches on the future of AML, including reducing duplication, the continued evolution and wider adoption of technology, the potential of Open Finance, and the ultimate aim of making UK property a robustly defended hard target against illicit funds.

To watch the webinar which accompanies this audio podcast, please click here.

To listen to more Landmark Talks Property episodes on Spotify, click here.

To find out more on Armalytix please visit armalytix.com

Building on the success of their new residential search reports launched last November, our parent company Landmark are delighted to unveil their new and improved commercial search reports.

The reports are designed to help commercial real estate professionals reduce the time spent interpreting data and access the information they need more easily.

Environmental Insights Remastered

Landmark’s remastered commercial reports feature unmatched data and clearly defined assessments that empowers commercial property lawyers to navigate the detail seamlessly. With enhanced clarity, they’ll provide all the relevant information to power confident decision-making.

Simple, straightforward, but never standard – led by commercial property lawyers

Landmark engaged with a large number of commercial property lawyers to shape the design and product brief. The overwhelming response was a call for reports that are more precise, easy to understand and easily direct you to the detail when required. Based on this valuable feedback, Landmark have refined the new commercial reports to be simple, straightforward, but with the most comprehensive information.

Comprehensive due diligence, made easy

- New and upgraded risk modules: Landmark have enhanced their reports to ensure they provide the most comprehensive reports in the market but also the simplest way to convey environmental risk.

- Optimised for today’s workflow: Visually enhanced front pages provide greater transparency for commercial property lawyers, saving valuable time.

- Executive summaries: New executive summary pages for both conveyancers and clients to quickly and easily understand which risks are relevant for that location and what to do next.

To view the remastered catalogue, click the related products links below. For details on Landmark’s new residential portfolio offering, click here.

The conveyancing sector is facing a perfect storm of challenges as 2025 gets up to full speed. Regulatory burdens and economic uncertainty, to the rise of AI and automation, all whilst battling clients demands and expectations; it’s a complex industry landscape, perhaps more so than ever before.

However, amongst these challenges, a spirit of resilience and proactivity is emerging. Conveyancers are taking control of the controllables; embracing innovation and seeking solutions to streamline processes and improve efficiency.

This shift in mindset is evident in the recent market research from Landmark Information Group. Over half of responders (52%) are now taking matters into their own hands by assigning workloads more effectively, while 34% are digitising more processes. Proactively sourcing new business and investing in improved training are also high on responders 2025 priorities.

What Tech Can Do For You

Understanding and integrating new technology can be a daunting task for conveyancing firms, especially with the rapid pace of recent advancements.

“Everybody’s grappling with the fact that the technological capabilities [in conveyancing] are accelerating at such a pace,” admitted Rob Steadman, Sales Director within Landmark Information Group.

“If you deploy AI today, tomorrow there’s almost like the next better version of AI to change it.”

Liz Jarvis, Managing Director of OneSearch highlights the need for dedicated education and training: “There’s an assumption by a lot of people that there’s all this information out there about tech, prop tech, and AI technology, and how it can help your firm. But actually, I don’t think that that’s fully translated into how it can be adopted.

“I think conveyancers and others doing this role, they actually need a lot more information about what that can do [for them] specifically, rather than big noise of a release of this technology. What does it mean to me and to my firm? How long will it take me? How long and what cost will it take for this to embed in my business?

“There’s the worry, what if I invest this money now? Is it obsolete in 12 months’ time?”

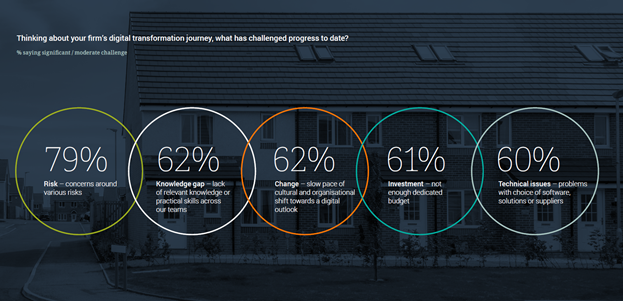

The feels are reflected in the market research; 62% of respondents listed the knowledge gap within their team as an aspect which has challenged progress, as well as the slow pace of change towards a digital outlook (62%).

Collaboration and Communication: Bridging the Gaps

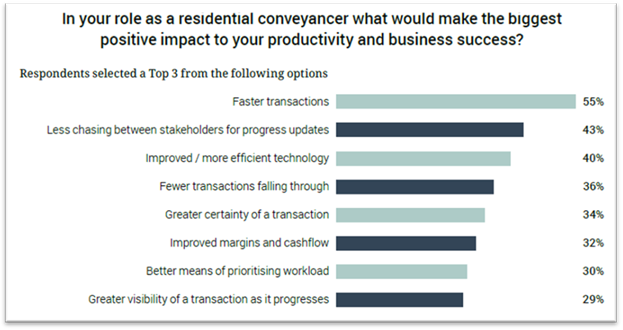

Another key theme for 2025 is the need for improved communication and collaboration among all stakeholders in the property transaction process. Participants highlighted the frustration caused by chasing information and the lack of transparency in the system.

Liz Jarvis continued along this point: “One of the biggest frustrations and things that is wasting time really is that chasing one another through all different parts of the process whether it would be a surveyor, an estate agent, the other side of the transaction, the purchaser or the vendor.

“I wonder why it’s taken a really long time. It feels like the thing we’ve never really been able to solve is this transparency or ability to see what other people are doing, putting information in a central place where everyone can access it together instead of it being phone calls and email.”

This desire for greater transparency and collaboration points to the need for solutions that can bring all stakeholders together in a central hub, providing a single source of truth and facilitating seamless information sharing.

Looking Ahead: A Call for Bold Leadership and Continued Innovation

The recent market research from Landmark paints a picture of a sector that is facing challenges head-on, embracing innovation, and actively seeking solutions to improve efficiency and client experience. Conveyancers are taking control, demanding more from technology providers, and prioritising collaboration and communication.

Moving forward, direction and continued innovation will be crucial. As Rob Steadman emphasised, “It’s going to come down to bold leadership across the sector to be clearly heard as to what their priorities are.”

By working together, conveyancers, technology providers, and other stakeholders can create a more efficient, transparent, and client-centric property transaction process. The challenges are real, but the opportunities are even greater.

The Landmark 2024 residential conveyancing survey tells a ‘tale of two halves’. One is about hope for economic stability as we enter autumn with listings and sales volumes rising, and interest rates falling. The other is about how conveyancers are still struggling with slow transaction times, insufficient resources, and general lack of transparency. For more details, be sure to download the market research results today.

OneSearch is delighted to co-host a unique networking event celebrating not only International Women’s Day 2025, but also our one-year partnership with our close friends at Ladies of Law!

Located at the iconic Jam House in Birmingham, this event will present an opportunity to celebrate women in law and the incredible achievements of our community.

Join us on 6th March from 6:00 – 8:30pm as we come together to celebrate women in law and their amazing achievements. This will be an incredible opportunity to network with professionals at all stages of their careers, exchange ideas, and celebrate the remarkable contributions of women in the legal industry.

What to Expect:

- A welcome drink to kick things off

- Delicious food to enjoy

- Live music to follow if you decide to stay and keep the celebration going!

- Inspiring talks from inspiring women

Claire Slade, Business Development Manager at OneSearch said: “We are incredibly excited to celebrate International Women’s Day and our one-year partnership with Ladies of Law. This event will definitely be a massive testament to the strength and achievements of women in the legal industry, and we look forward to an evening of inspiration, connection, and celebration.”

Ella Watts, the founder of Ladies of Law, added: “We cannot wait for this networking event, which will be our first of the year, and our first in Birmingham. Any opportunity to bring together an amazing group of professionals is reason enough to celebrate, but to have it the week of International Women’s Day, as we also commemorate one year of partnering with OneSearch makes it even more special. This event will be all about recognising the incredible contributions of women in law and fostering a supportive community where we can all thrive.”

It’s going to be a magical evening, and we’d love for you to be part of it. Tickets will be limited, so make sure you don’t miss out!

Environmental insights are changing!

Our parent company Landmark Information Group are thrilled to share the launch of a remastered range of residential environmental search reports specifically designed to help you feel confident with search results, spend less time interpreting data and more time delivering excellent customer service.

Environmental Insights Remastered

Landmark’s remastered reports will still contain unmatched data and renowned in-house expert support but now with greater clarity, helping you navigate the most complex transactions, seamlessly.

Remastered content and design, led by conveyancers

To support these latest updates, Landmark engaged with over 200 residential conveyancers, from high street to multi practice firms; the invaluable feedback they provided together with Landmark’s 30 years of experience in property and land data, has allowed Landmark to remaster and shape environmental reports that properly satisfy the need for readability, comprehension and expediency.

Comprehensive due diligence, made easy

- New and upgraded risk modules to ensure we provide not only the most comprehensive reports in the market but the simplest way to convey environmental risk.

- Visually enhanced front pages – providing greater transparency for conveyancers to save valuable time.

- New executive summary pages for both conveyancers and homebuyers to understand quickly and easily which risks are relevant for that location and what to do next.

- Homebuyer guidance – to ensure your clients understand the report context.

Remastered Delivery

From the research Landmark carried out, PDF delivery is still extremely popular, but there was an awareness that digital formats will be the future moving forward. To support and prepare conveyancers with this transition Landmark’s remastered reports will be digitally enabled, giving choice on how you want to receive environmental insight information in the future.

To view the remastered catalogue, click the related products links below.