Subsidence and mining aren’t exactly the glamorous side of property (unless you’re particularly fond of soil classifications), but they’re hugely important for understanding how safe, stable and mortgage‑friendly a home really is.

For conveyancers, agents and lenders, these risks sit quietly beneath the surface – sometimes literally – waiting to be discovered during due diligence.

For buyers, too, they matter more than most realise. After all, nobody wants to move into their dream home only to learn it’s doing a gradual impersonation of the Leaning Tower of Pisa.

What Do We Mean by Subsidence?

Subsidence is the downward movement of the ground beneath a building, causing the structure to shift or crack. It can be triggered by:

Shrink‑swell clay soils

These expand in winter, contract in summer, and generally behave like a moody teenager – unpredictable and occasionally dramatic.

Tree roots

Large trees can draw moisture from the soil, causing it to contract. Lovely to look at, less lovely when your bay window starts to twist.

Drainage or leaks

Escaping water can wash away fine materials in the soil, undermining foundations.

Historic development or ground disturbance

Old landfills, made‑up ground or former industrial plots can behave inconsistently over time.

While many causes are harmless or easily managed, some require early attention to avoid major repair bills later.

Where Does Mining Risk Come In?

Mining activity, especially historic coal, tin, ironstone or chalk works, can leave behind voids, shafts, tunnels or weakened ground. These aren’t always obvious on the surface, but they can affect stability long after the last miner clocked out.

Mining risks can include:

- Old mine workings

- Collapsible ground

- Unrecorded shafts

- Opencast sites

- Ground gas issues in former mineral areas

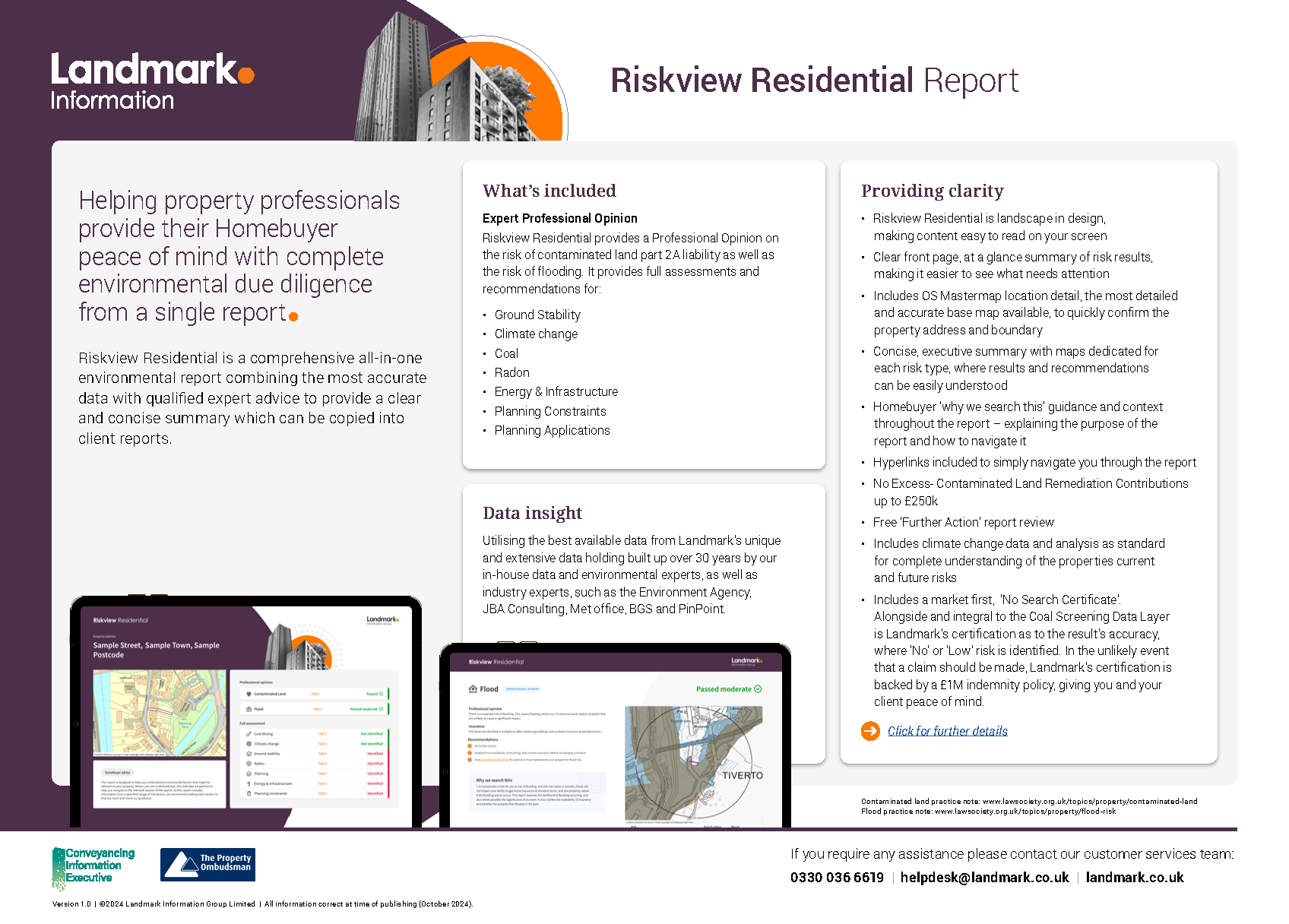

Properties in historic mining regions often require a specialist mining report, which is as thrilling as it sounds but very important.

Why Subsidence & Mining Matter in Conveyancing

Both issues influence safety, long‑term maintenance, mortgageability and insurance. Lenders want reassurance that the property isn’t at unusual risk, insurers want to price the risk accurately, and buyers want walls that don’t crack every time it rains.

Common red flags include:

- Reports of past subsidence

- Claims history

- Local geology indicators

- Known mine workings

- Previous stabilisation works

- Structural movement noted in surveys

Explaining these clearly to clients builds trust and helps them understand whether the risk is low, manageable or something that needs deeper investigation.

How Buyers Can Protect Themselves

Fortunately, most subsidence and mining risks can be understood early through:

- Environmental and mining searches

- Building surveys

- Engineer evaluations where needed

- Local authority knowledge

- Specialist Coal Authority reports

- Checking insurance history

- Talking to neighbours (always more fun than it sounds)

Early clarity helps avoid renegotiations, insurance surprises or unwelcome discoveries after completion.

Subsidence and mining might not be the most exciting topics at a viewing, but they’re among the most important. These issues don’t have to be deal‑breakers; in fact, most are perfectly manageable when spotted early. The real value comes from taking a calm, methodical look at the property’s history and the ground beneath it.

Think of subsidence and mining risks as the quiet characters in the background of the transaction: not showy, not dramatic, but incredibly influential. Spot them early, explain them clearly, and your clients will feel far more grounded… in every sense.

Related Articles

All Environmental Risks Covered in Landmark Reports: Introducing Landmark’s Enhanced Residential Product Portfolio

Envirosearch

RiskView Residential

Landmark Coal

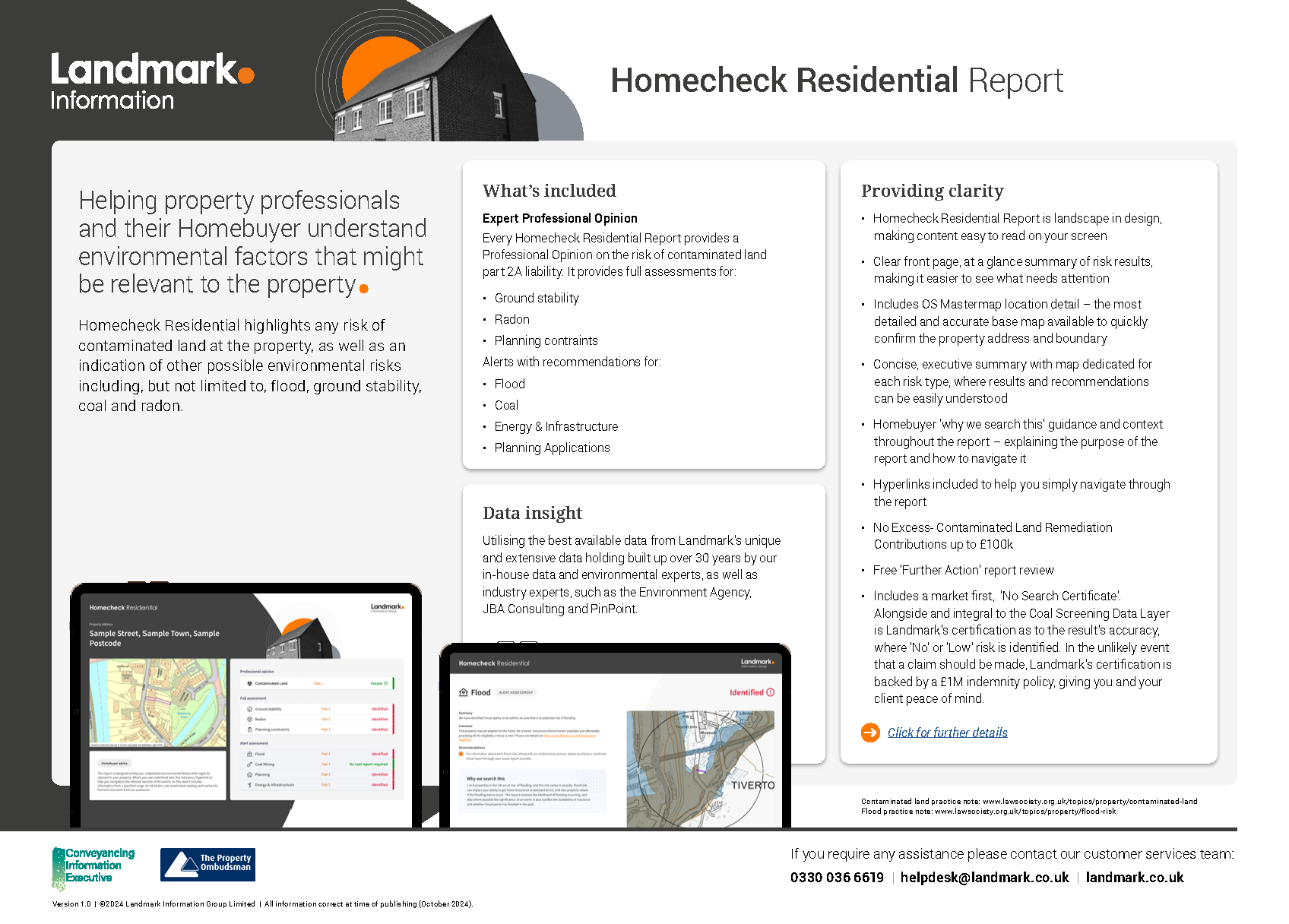

Homecheck Residential

Five Minutes On… Biodiversity Net Gain

Five minutes on… Local Development Plans